Page 11 - Active Export E-Program - Furniture Sector

P. 11

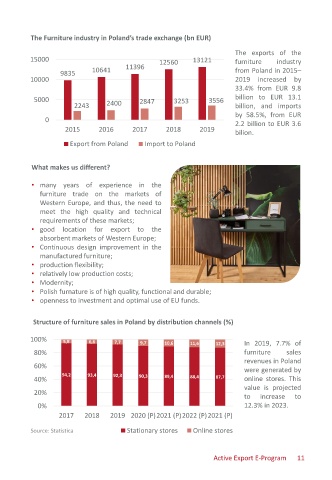

The Furniture industry in Poland’s trade exchange (bn EUR)

The exports of the

15000 12560 13121 furniture industry

11396

10641 from Poland in 2015–

9835

10000 2019 increased by

33.4% from EUR 9.8

5000 2847 3253 3556 billion to EUR 13.1

2243 2400 billion, and imports

by 58.5%, from EUR

0

2.2 billion to EUR 3.6

2015 2016 2017 2018 2019

bilion.

Export from Poland Import to Poland

What makes us different?

• many years of experience in the

furniture trade on the markets of

Western Europe, and thus, the need to

meet the high quality and technical

requirements of these markets;

• good location for export to the

absorbent markets of Western Europe;

• Continuous design improvement in the

manufactured furniture;

• production flexibility;

• relatively low production costs;

• Modernity;

• Polish furnature is of high quality, functional and durable;

• openness to investment and optimal use of EU funds.

Structure of furniture sales in Poland by distribution channels (%)

100% 5,8 6,6 7,7 9,7 10,6 11,6 12,3 In 2019, 7.7% of

80% furniture sales

revenues in Poland

60%

were generated by

94,2 93,4 92,3 90,3 89,4

40% 88,4 87,7 online stores. This

value is projected

20%

to increase to

0% 12.3% in 2023.

2017 2018 2019 2020 (P)2021 (P)2022 (P)2021 (P)

Source: Statistica Stationary stores Online stores

Active Export E-Program 11